The Man Who Foretold the 2008 Financial Crisis and Amassed £600 Million: An In-Depth Look at a Financial Prophet

In the world of finance, few moments are as defining as the prediction of a major economic downturn. It is a rare talent to foresee such a crisis before it unfolds, and even rarer to profit substantially from that foresight.

One man, whose name has become synonymous with prescient financial analysis, did exactly that.

He predicted the catastrophic 2008 financial crisis—a seismic event that shook global markets—and, in doing so, amassed a staggering fortune of £600 million.

This story is not just about wealth; it’s about insight, risk, and the extraordinary capacity to read the complex signals of the global economy before the rest of the world catches on.

The Background: A Financial Visionary Emerges

The story begins with a man whose background is as intriguing as his foresight. Born and raised in a modest family, he demonstrated an early interest in economics and markets.

Unlike many of his peers, who followed conventional paths, he dedicated himself to understanding the intricacies of financial systems, credit markets, and economic indicators.

Over the years, he cultivated a reputation as a sharp analyst—someone who could see beyond the noise and identify underlying vulnerabilities in the global financial architecture.

The Lead-up to the Crisis: A Ticking Time Bomb

By the early 2000s, the global economy was experiencing unprecedented growth, fueled by a housing bubble in the United States and widespread credit expansion.

Financial institutions were increasingly engaging in risky practices, securitizing subprime mortgages and trading complex derivatives.

While many investors and analysts remained optimistic, our subject was scrutinizing the warning signs: the rising levels of household debt, the proliferation of mortgage-backed securities, and the overvaluation of real estate markets.

He meticulously studied the data, connecting the dots that others failed to see. His analysis revealed that the system was fundamentally unstable, teetering on the brink of collapse.

Yet, despite his warnings, the prevailing sentiment was bullish, and the mainstream financial media largely dismissed his concerns.

The Prediction: A Moment of Clarity

In the months leading up to 2008, he publicly voiced his concerns about an impending financial crisis. He issued reports, gave interviews, and even wrote articles warning of the bubble’s burst.

His predictions were met with skepticism, ridicule, or outright dismissal by many in the investment community who believed that the market could sustain its momentum indefinitely.

However, he remained steadfast. His models indicated that the housing market was unsustainable, and when the inevitable correction occurred, he knew it would trigger a domino effect across financial markets worldwide.

The Crash Unfolds: The World Watches in Shock

When the housing bubble burst in 2007-2008, the fallout was swift and severe. Lehman Brothers filed for bankruptcy, stock markets plummeted, and millions of people lost their jobs and savings.

The global economy was plunged into a deep recession, with governments scrambling to stabilize their financial systems.

Amidst the chaos, our visionary investor’s predictions proved eerily accurate. While many suffered losses, he had positioned himself to benefit from the collapse.

His strategic investments in certain derivatives, short positions, and distressed assets allowed him to capitalize on the downturn.

The Fortune Made: £600 Million in Profits

Thanks to his foresight and strategic positioning, he amassed an astonishing fortune of £600 million during the crisis. This level of profit is extraordinary, especially considering the scale of the economic upheaval.

His success was not merely luck; it was the result of meticulous analysis, disciplined risk management, and a deep understanding of financial markets.

His story became a case study in the world of finance—an example of how insight into systemic risks can lead to immense wealth, even amid global economic turmoil.

The Aftermath: A Legacy of Insight and Controversy

Following the crisis, the man’s reputation grew. Some hailed him as a visionary—a financial prophet who saw the collapse coming and profited ethically from his knowledge.

Others criticized him as a opportunist who exploited others’ suffering. Regardless of perspective, his story raises important questions about market transparency, risk management, and the ethical responsibilities of investors.

He used his newfound wealth to invest in philanthropic ventures, support financial education, and advocate for reforms to prevent future crises.

His journey from a cautious analyst to a billionaire investor is a testament to the power of insight and the importance of understanding the underlying forces shaping the economy.

Lessons Learned: The Power of Foresight in Finance

His story underscores several key lessons for investors, policymakers, and the public:

The importance of independent analysis: Not all market signals are clear, and it takes courage and expertise to challenge prevailing narratives.

Risk awareness: Recognizing systemic vulnerabilities can lead to both significant profits and the ability to mitigate losses.

Ethical considerations: Profiting from crises raises questions about responsibility and morality in finance.

Preparation and resilience: Those who understand potential risks can better prepare for downturns, safeguarding their assets and contributing to overall stability.

Conclusion: A Legacy of Prediction and Profit

In the end, this man’s ability to foresee the 2008 financial crisis and turn that insight into a £600 million fortune exemplifies the extraordinary potential of analytical prowess in the financial world.

His story continues to inspire investors and analysts alike, reminding us that beneath the complex web of markets, there are signals waiting to be read—if only one has the vision to see them.

As the global economy evolves, lessons from his experience remain relevant: vigilance, understanding systemic risks, and acting decisively can make all the difference in navigating the turbulent waters of finance.

His journey from a cautious analyst to a billionaire investor is a testament to the power of foresight—and a compelling story of how one person’s vision can change their destiny and influence the world.

News

Nikola Jokić Dominates Stat Sheet to Propel Denver Nuggets to Victory in the Emirates NBA Cup West Group C

Nikola Jokić Dominates Stat Sheet to Propel Denver Nuggets to Victory in the Emirates NBA Cup West Group C In…

Nighting the American Dream: Celebrating Patriotism and Heroes with Fox Nation Patriot Awards

Nighting the American Dream: Celebrating Patriotism and Heroes with Fox Nation Patriot Awards In a nation built on the ideals…

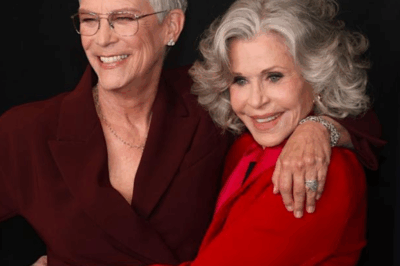

Jamie Lee Curtis Celebrates Democratic Victory in Election Day Sweep as She Accepts Prestigious Jane Fonda Humanitarian Award

Jamie Lee Curtis Celebrates Democratic Victory in Election Day Sweep as She Accepts Prestigious Jane Fonda Humanitarian Award In a…

Tragic Loss: Washington University Goalkeeper Mia Hamant Passes Away at 21 After Battling Rare Kidney Cancer

Tragic Loss: Washington University Goalkeeper Mia Hamant Passes Away at 21 After Battling Rare Kidney Cancer St. Louis, MO —…

Celebrating the Legendary Joni Mitchell: A Heartfelt Birthday Tribute to an Icon of Music and Art

Celebrating the Legendary Joni Mitchell: A Heartfelt Birthday Tribute to an Icon of Music and Art As the calendar marks…

Kiyomi “The Product” McMiller Set to Take Center Stage at Penn State: A Comprehensive Preview

Kiyomi “The Product” McMiller Set to Take Center Stage at Penn State: A Comprehensive Preview Kiyomi “The Product” McMiller, a…

End of content

No more pages to load